Underpants, luxury cars and instant loans – false identity can get you anything!

Uutinen07.09.2017

In 2015-2016, an exceptionally large-scale series of frauds was committed, in which three men committed hundreds of frauds and scams using false identities. In all, these caused companies to suffer losses of more than half a million euros. At Asiakastieto the case was studied thoroughly for learning purposes.

An Oliver duvet jacket 138-147cm (498€), Genifique Repair night cream (94€), packet of XL-sized boxer shorts and Opera hipster underwear (38€), two used Jaguar cars with hire purchase, dozens of instant loans and other credits. What is this about?

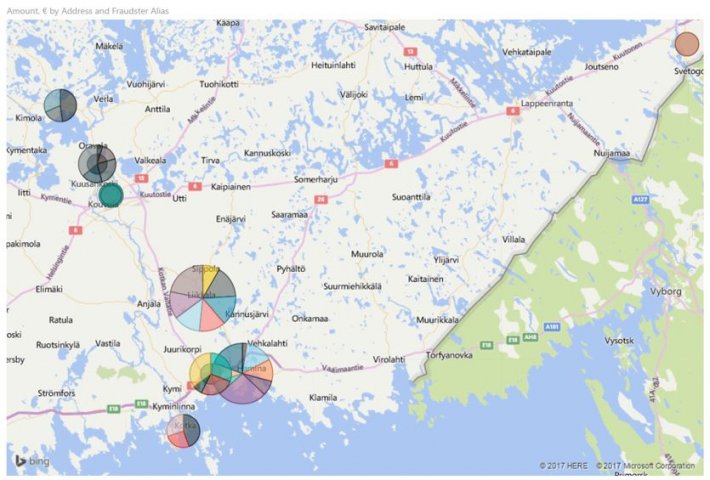

The fraudster trio, which operated mainly in Southeast Finland, committed dozens of order frauds using false identities, raised loans on the web and acquired cars with hire purchase – without the slightest intention to pay back their acquisitions. Finally, after busy eighteen months they had accomplished about 400 separate cases, causing losses of altogether 535 000 euros to 41 companies. The District Court of Kymenlaakso sentenced the leading person of the trio to two year’s imprisonment, among others, for aggravated frauds, forgeries and falsifications of register entries. The other two were given sentences of 8 months and 1 year and 2 months, respectively. Naturally, they were ordered to compensate the damages caused to the subjects of frauds.

Suomen Asiakastieto Oy conducted a voluminous study of the series of frauds because of its exceptional immensity. In the future, the learning gained from the case will be directed to the service development and for the use of clients.

”Because frauds and other criminal activities appear to have increased significantly, our intention was to find out in detail how such a massive and long-term pattern was managed. At the same time, we want to develop means for our clients to identity attempts of fraud”, says Development Manager Pekka Lattu in charge of the study.

The trick and how it was done

How was all this possible? How was credit obtained and business conducted on invoice, when at least the major part of companies checks the credit information of their consumer customers? The trio acquired the most important material for their fraud factory, i.e. the personal information entered in the applications by bringing people from Sweden. They arranged the trips of these people to Finland and transported them to Southeast Finland, where mainly addresses in Kouvola and Hamina were given as their places of residence to be registered at the local registry office. After this they were further transported to different locations in Finland, and accounts were opened for them at different banks, the identifiers for their control ending up to the hands of the trio. This way the three men had the means to deceive e-shops and companies granting credits on the web.

When the criminals had managed to find a method with which a considerable part of the fraud attempts succeeded, they started to repeat it. A similar method was finally repeated using about 30 different identities.

”Based on the list of the conned companies it can be concluded that the swindlers learned to know the companies, in which risk management was not in order, and the fraud could be committed more easily”, Pekka Lattu observes.

The swindlers’ hunger grew, and web cons were no longer enough. They also took their dummies to car dealerships, where they signed hire purchase agreements. False address, employer and salary information was given in the application and the users of the cars were not revealed. In fact, the cars were immediately transported to Sweden.

Immigration date is valuable information

Staying abroad doesn’t make anyone a criminal, but the immigration date has a great significance as part of the credit decision process. Finnish credit information on a person who has recently arrived in the country does not give a good view of the person’s payment pattern. When there are no payment transactions in Finland, there cannot be any payment default entries in the credit data file, either. This can be a signal for transferring the application to be processed in more detail.

The crook trio began to use the wrongly gained identities very soon after the place of residence had been registered in Finland. Typically, applications were made right away, and only a bit more than a week passed from the visit at the local registry office to the raising of the first loan. For one checking the immigration date from the Population Register this might have raised the justified question of why the immediate credit application? In this case, it would certainly have been worthwhile to transfer the application to more detailed processing, in which the criminal intentions would probably have been detected and the credit would not have been granted.

As the fraud chain proceeded credits started to accumulate from several companies to the same applicants and they were not paid back or amortized. The consumer credit companies using Asiakastieto’s data exchange service succeeded in avoiding losses, because at least they did not grant any more credits after noticing that the applicants already had several unpaid credits. The first actual payment default entries were registered to the identities used by the fraudsters typically after approximately four months from the immigration date. Thus, the payment default data was not enough to warn about the fraud, but faster information was needed.

Hints for the identification and prevention of frauds when making credit decisions:

- Check the applicant’s Population Register information. A recent immigration date is a sign that it is worthwhile to examine the application more closely.

- Check as accurately as possible the applicant’s other credits; have they been recently raised and have they been paid according to schedule.

- Check from your own customer file, if residents possibly reported to live at the same address have made orders or raised loans recently. Applications from the same address but different persons may be a sign of an attempted fraud.

Text: Ville Kauppi. The article is originally published in Finnish by Luottolista

Takaisin

Takaisin

Uutisarkisto

Uutisarkisto Pörssitiedotteet

Pörssitiedotteet Kuvat ja logot

Kuvat ja logot